With two-thirds of 2025 behind us as of; and India’s key festival period approaching, the electric four-wheeler passenger-vehicle market is showing clear momentum even as global trade tensions and component-supply risks create headwinds. This article reviews year-to-date developments in the Indian Electric Vehicle (EV) market, the wave of new model introductions, evolving OEM strategies, and what the rest of the year may hold.

Fig: EV car charging || pic credit: archit f

Fig: EV car charging || pic credit: archit f

Background

2025 has been the year major Original Equipment Manufacturers (OEMs)moved from EV testing to production. Just last week, the legacy manufacturer, Maruti Suzuki, launched its first, battery only global EV, e-Vitara and started its production at the Gujarat plant. Mahindra expanded its EV line-up with the BE.06 (BE6) and the XEV 9e among its new models. Hyundai introduced a Creta Electric for the Indian market earlier this year.

Tata Motors continued its EV portfolio expansion with the Harrier.ev. Meanwhile, MG Motors have been aggressively focussed on building its presence in the EV segment with 84% of MG sales coming from its EV portfolio in July 2025. Furthermore, Vinfast, a Vietnamese electric-only 4W manufacturer, set up a manufacturing plant in Tamil Nadu and officially launched two models for the Indian market in Bharat Mobility Global Expo 2025.

However, the policy support for electric cars shifted in 2024; earlier FAME-II explicitly included demand incentives for electric four-wheelers, while PM E-DRIVE (the successor program) focuses incentives on E-2W, E-3W, E-buses, E-trucks and charging infrastructure, and does not provide the same central purchase subsidies for passenger cars.

This resulted in a massive drop in the growth of E-4W sales in 2024. However, multiple OEMs launched mainstream EVs in 2025. Furthermore, state subsidies, lower GST, improved affordability (falling battery costs, financing offers, BaaS and OEM festival promotions), fleet electrification and charging infrastructure expansion have collectively offset the reduction in national demand incentives. These forces made a near-term recovery for the e-4W segment plausible despite the policy shift.

Diving Deeper

The electric passenger four-wheeler segment is at the cusp of mass-market adoption. Our estimates suggest that between 2020-2025, the E-4W segment is expected to grow at the massive CAGR growth rate of 110%. By contrast, the broader 4W market grew at about 12% CAGR. The EV penetration for 4Ws (total nos. of E-4Ws/total nos. of 4Ws) is estimated to be 20x as compared to 2020 reaching 4% in 2025.

| Year | E-4W sales | Total 4W sales | E-4W penetration | E-4W sales YoY growth | Total 4W sales YoY growth |

| 2020 | 4,207 | 24,53,499 | 0.2% | ||

| 2021 | 13,002 | 29,85,857 | 0.4% | 209% | 22% |

| 2022 | 38,170 | 34,53,722 | 1.1% | 194% | 16% |

| 2023 | 80,121 | 37,53,065 | 2.1% | 110% | 9% |

| 2024 | 93,551 | 38,91,155 | 2.4% | 17% | 4% |

| 2025 (Jan-July) | 85,399 | 23,52,341 | 3.6% | ||

| 2025E | 1,74,887 | 43,26,376 | 4.0% | 87% | 11% |

*Note: 2025E is an estimation of yearly sales for 2025

Table 1: Breakup of 4W sales from 2020-2025

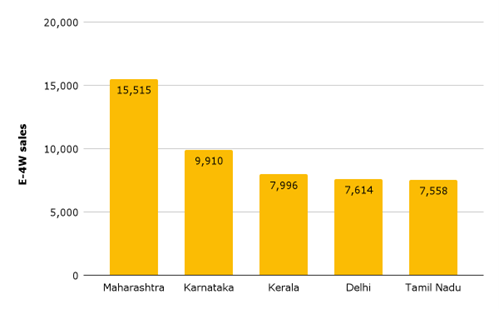

A granular analysis of the E-4Ws sales in 2025 across geographies show that the only five states are responsible for a striking 57% of the total E-4W sales.

Figure 1: E-4W sales | January-July (2025)

Figure 1: E-4W sales | January-July (2025)

These states also witnessed remarkable growth in the E-4W segment in the same time-frame (January-July) as last year.

Figure 2: E-4W sales | January-July (2024 vs 2025)

Figure 2: E-4W sales | January-July (2024 vs 2025)

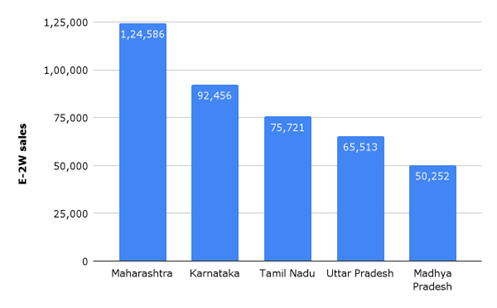

The E-4W sales in Maharashtra nearly doubled, while Tamil Nadu reported 72% YoY increase in sales. The strong demand for electric vehicles in Maharashtra is not just limited to passenger cars. The state is also leading the E-2W adoption in 2025. The E-2W sales in the financial capital stood at about 1,25,000, about 35% higher registrations than the successor, Karnataka (~92,000).

Figure 3: E-2W sales | January-July (2025)

Figure 3: E-2W sales | January-July (2025)

The strong adoption of electric vehicles across categories in Maharashtra is largely a result of its aggressive state policy. Maharashtra is one of the few states that still offers direct purchase incentives for EVs and waives significant road taxes;measures that materially improve the upfront economics for buyers. These policy levers have helped shift consumer preference toward cleaner transport options.

This policy-led intervention for accelerating the adoption of EVs in the state is commendable, because Maharashtra is neither the automotive manufacturing hub like Tamil Nadu nor beats the startup ecosystem of Karnataka. Yet, policy has created a local market pull strong enough to overcome those structural differences.

Key Takeaways

- Demand is responding when product choice and price align: mainstream nameplates going electric in addition to festival-season promotions will drive near-term volume.

- State policies can meaningfully accelerate adoption, Maharashtra’s example shows that demand incentives and tax waivers still move the needle.

- Supply-side resilience (cells, semiconductors, localization) and a faster public fast-charging rollout are the binding constraints to convert intent into sustained growth.

- OEM strategies will separate winners from followers: scale, flexible pricing/finance, and after-sales for EVs will be decisive.