The road to India’s EV future runs through smarter subsidies, sharper strategy, and seamless centre-state synergy

It has been a decade since India dreamed of a future with clean and sustainable transport by electrifying its cars, bikes, scooters, three wheelers, trucks and buses. It turned this into a reality by introducing central and state level policies designed to promote EV adoption through various fiscal incentives and PLI schemes. As a result, vehicular data from the last 10 years shows that nearly 2% of India’s total registered vehicles are now electric, amounting to 5.2 million vehicles out of the total 253 million plying on the country’s roads (source CMS’s EV dashboard, excluding trucks and tractors. While this growth is impressive, the EV industry continues to face challenges of high upfront cost, expensive financing, limited charging infrastructure, and domestic battery supply chain.

The current policies have brought us this far in the EV journey, but the question remains whether India can achieve its goal of 10 million EVs on road by 2030 with existing policy design? Have the public expenditure from these policies translated into proportionate returns in terms of vehicle adoption and market transformation?

A recent report by IEEFA answers these questions. It is a landmark report that offers data driven insights into how different fiscal incentives - mainly demand side purchase subsidies at both the central and state level, and supply side PLI programmes - have shaped EV adoption across vehicle segments.

Snapshot of India’s EV landscape

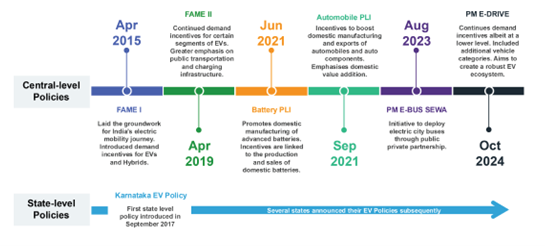

India’s central policies alone, such as FAME I and II, EMPS 2024, PM E-Drive, PM e-Bus SEWA, PLI automotive and auto components, PLI battery, have a total budget outlay of a whopping Rs 7,12,680 million, or $8,587 million. Above this, there are 33 state and union government EV policies, with each of them offering some form of fiscal incentives.

Source: IEEFA report From Incentives to Adoption: A decadal review of India’s EVsubsidy effectiveness

Source: IEEFA report From Incentives to Adoption: A decadal review of India’s EVsubsidy effectiveness

So what does the analysis of EV policies and sales data tell us?

Electric two wheelers: Sky rocketing 9x, but falling short of orbit!

FAME II had the highest impact on the sale of electric two wheelers as it increased the average subsidy to Rs 12,000 per kWh (from Rs 5,000 per kWh under FAME I), significantly bringing down upfront cost. Close to 1.63 lakh electric two wheeler sales can be directly attributed to FAME II subsidy, and during the policy period, actual sales reached 14.4 lakh. This implies that the policy helped E2W sales grow 9x faster, which can also be interpreted as each rupee of policy driven value led to nearly Rs 9 in total market creation. This multiplier effect resulted in an estimated 2.8 million tonnes of CO₂e avoided over the lifetime of these vehicles. State level analysis shows that state purchase subsidy policies generated a significant 54.5% increase in E2W sales volume compared to states where only central policies were implemented.

However, while FAME-II and state policies significantly boosted absolute E2W sales, it did not meaningfully increase the EV penetration rate, which stayed at nearly 4% by the end of 2024. This gap suggests that purchase subsidies alone, even at higher intensities, cannot transform overall market composition without complementary measures.

Electric three wheeler (passenger): FAME I’s 10X miracle that is now on cruise control

Passenger E3Ws responded remarkably well to FAME I even with modest subsidy support. Close to 27,000 E3W sales can be directly attributed to FAME I, which would otherwise not have entered the market. By the end of FAME I in March 2019, actual sales reached 2.67 lakh, implying a 10X growth thanks to this scheme. This means for every rupee of policy driven value, a market of Rs 10 was created. And this saved nearly 5.53 million tonnes of CO₂e over the lifetime of these vehicles.

The report reveals that FAME II’s direct impact appeared insignificant, but the E3W passenger market demonstrated year on year growth of more than 40% till 2023. This shows that FAME I was successful in transforming this segment into a self sustainable market, now driven by commercial demand. E3W penetration in the country stands at 53% by the end of 2024.

Electric three wheeler (cargo): The quiet champion, powered more by profit than incentives

This segment achieved a 31% market share by 2023, but the report’s analysis shows insignificant correlation between FAME subsidies and sales data. This tells a more nuanced story about the market drivers. For every 1% decrease in operating costs of E3W cargo compared to ICE, it increased sales by 0.5% and adoption rates by 0.16%. This shows the growth is driven by operational economics.

But at the state level, data shows that states with purchase subsidies have 30.1% higher sales and 8.4% higher adoption rate of E3W cargo compared to states without purchase subsidies in their policies.

Commercial four wheeler EVs: Exponential response to incentives, but barriers remain for higher penetration

FAME II proved a fantastic trigger for this segment, catalysing growth by 21 times. In 2019, this segment had a mere 959 vehicles, but after FAME II’s introduction, units jumped to 40,000 in 2023. In ROI terms, every rupee invested through FAME II generated a market of Rs 21. The introduction of both PLI schemes had the strongest impact on this segment, with sales growing from 18,500 in 2022 to 40,000 in 2023. This indicates that addressing supply-side constraints through manufacturing incentives has been particularly effective for this segment.

Further, states with EV subsidies experienced approximately 211% higher (three times) sales compared to states without such incentives.The report also finds that for every 1% decrease in operation cost, sales increased by 5.45%.

Despite these positive policy impacts, overall sales numbers for electric cars remain low compared to conventional vehicles with an AR just below 1% by the end of 2023, suggesting that while policy support helps, significant barriers to mass adoption persist.

There is a need for a central policy programme for electric cars, as they have demonstrated strong sensitivity to subsidies, but they are currently excluded from national level schemes like PM E-DRIVE.

Electric buses: A bumpy road

The report finds no statistically significant positive effect of any central or state policy on e-bus sales or adoption, for the following reasons.

- Most of India’s 2 million registered buses serve private inter-city or tourist routes, while more than 7% are publicly owned and operated by STUs. This limits the reach of policies that rely on STUs as the primary channel of deployment. Even within STUs, financial constraints, procurement delays, and capacity limitations have slowed the rollout.

- High upfront costs and limited financing options continue to constrain adoption. Even after FAME-II subsidies, e-buses are often 2-3 times more expensive than comparable diesel buses. Smaller private operators, who make up the majority of the sector—struggle to access long-tenure, low-interest loans that could offset this cost differential.

- Operational complexity and lack of enabling infrastructure remain major hurdles. While depot-based charging is feasible for intra-city STUs, inter-city or regional operations require corridor-based fast charging, reliable electricity supply, and multi-jurisdiction approvals—factors not fully addressed by existing policies.

Fig 1: Ola Electric's S1 Air e-scooters are pictured inside its manufacturing facility in Pochampalli in the southern state of Tamil Nadu, India, August 15, 2023. REUTERS/VarunVyas Hebbalalu/File Photo

Fig 1: Ola Electric's S1 Air e-scooters are pictured inside its manufacturing facility in Pochampalli in the southern state of Tamil Nadu, India, August 15, 2023. REUTERS/VarunVyas Hebbalalu/File Photo

Key lessons for designing future policies

The biggest takeaway - the sector has expanded fast on the back of government incentives, but long term growth will require the centre, state and industry to work in tandem. One size doesn’t fit all - subsidy effectiveness varies significantly across vehicle segments. States play an important role in amplifying impact, especially as central subsidies dwindle. Economics drive commercial EVs more than incentives and this segment would benefit from focusing on operating costs. Going forward, subsidies must evolve from blunt purchase discount to smart financing.

- E2W: Continue offering incentives but plan a phase down. Invest in the ecosystem by building reliable public charging infrastructure, and address consumer concerns around battery life, resale value, and long-term maintenance to boost confidence in EV ownership.

- E3W passenger: Focus on the financing ecosystem more than subsidies through specialised loans, low cost credit lines for NBFCs. Strengthen supply chain and manufacturing through PLI schemes.

- E3W cargo: Phase down direct subsidies systematically. Invest in building the EV ecosystem. Expand specialised financing for small operators to reduce upfront costs, especially in underpenetrated areas.

- E4W commercial: Reinstate a minimum central subsidy, currently missing in PM E-Drive. Strengthen manufacturing policies alongside demand incentives. Higher focus on TCO to make them competitive with CNG.

- E4W passenger: Implement fiscal measures to reduce upfront cost like tax waivers, lower GST rate, and non fiscal measures like green zones, free public parking, lower toll charges. Strengthen public charging infrastructure.

The road to India’s EV future runs through smarter subsidies, sharper strategy, and seamless centre-state synergy. The time to rewire EV policy for higher penetration is now.