NITI Aayog’s latest report, "Unlocking a $200 Billion Opportunity: Electric Vehicles in India," shows that India’s EV sales have jumped from 50,000 units in 2016 to around 2.08 million in 2024. That’s an impressive 41X growth in 8 years. However, EVs still only account for 7.6% of the country’s total new vehicle sales when the target remains 30% by 2030.

Fig 1: EV Sales and EV Stock over the years (Global and India)

Fig 1: EV Sales and EV Stock over the years (Global and India)

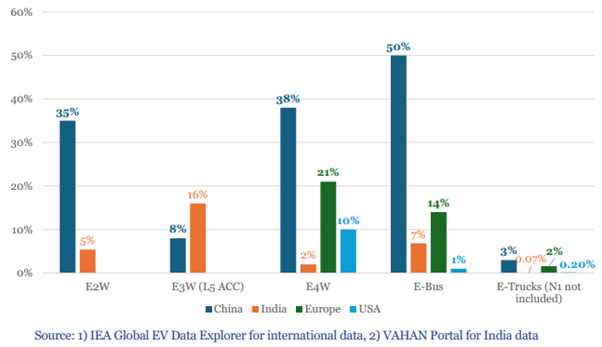

Progress Against Peers: Where Does India Stand?

India’s EV adoption still lags the global growth curve (figure 1), with the overall EV penetration breaching 16% globally. That said, reasonable progress has been seen in electric bus adoption, but the uptake of electric cars and long-haul trucks remains slow. For context:

- Only 6,220 electric trucks were sold in India in 2024 (out of the total 834,578 units)—95% of these are under 3.5 tons, mainly for short-haul urban freight.

- In the long-haul (>3.5 ton) segment, only 280 trucks were electric in 2024—as opposed to 76,000 in China.

Figure 2: EV penetration rate across China, India, Europe & US in different vehicle segments in 2023

Figure 2: EV penetration rate across China, India, Europe & US in different vehicle segments in 2023

Barriers to Rapid Adoption: Financing, Infrastructure, Awareness

The report highlights the following barriers to speedier adoption:

-

- Financing Issues: Electric buses and trucks are 2-3 times the price of traditional internal combustion engine (ICE) vehicles, and truck and bus ownership in India is very fragmented - most owners operate five or fewer vehicles. As a result, financiers view them as riskier investments while they are costlier options to the smaller businesses.

Fig. 3: Long-haul trucks are a prime candidate for electrification since they often run on fixed routes and can be paired with strategically-placed charging stations | Source: https://www.fleetequipmentmag.com/

Fig. 3: Long-haul trucks are a prime candidate for electrification since they often run on fixed routes and can be paired with strategically-placed charging stations | Source: https://www.fleetequipmentmag.com/Suggested Solution: The report recommends using blended finance options (such as government and multilateral banks working together), priority sector lending, or risk-pooling to lower the financing costs of Electric Vehicles (EVs) over their diesel competitors.

- Infrastructure Gaps: Insufficient and poorly used charging stations are still a major barrier, with the challenges being:

- Long timelines for power supply connections, as well as misaligned fee/tariff structures

- The high cost of public charging, which is about four times higher than home charging costs (due partly to 18% GST)

- The difficulties with land acquisition for public chargers

- Poor coordination between the utilities, urban departments and charge point operators

Suggested solution: A strategic scaling of infrastructure with charging stations installed to serve traffic patterns, instead of affording uniform access across the city. E.g. at truck stops, logistics hubs and dense urban clusters to meet pre-established demand.

- Awareness and Information Shortcomings: The development of a single information source is necessary for evidence-based policy decisions, engagement of users, and the interoperability of battery, vehicle, and charging data.

Recommendations: A New Approach for India’s EV Revolution

The NITI Aayog report crystallizes its recommendations primarily around:-

- Transitioning from Incentives to Mandates:

Specifically, mandates around the gradual production and purchase of electric vehicles and disincentivising internal combustion engine (ICE) vehicles. The phased development and manufacture of zero-emission vehicles (ZEVs), the expansion of emission norms, penalties or extra taxes on ICE vehicles are examples of regulatory mandates that will send clear signals to manufacturers, fleet operators, and consumers to move towards electric vehicles. - Prioritizing High-Impact Segments:

This implies buses, urban freight vehicles, trucks, and para-transit vehicles. Also, these vehicles tend to operate on more predictable routes, allowing charging infrastructure to be strategically deployed. - Saturation in Limited Geographies:

When key cities have nearly 100% EV penetration, results are easily tracked and managed, and more easily replicated, rather than having similar levels of EV penetration all over India. It also allows for lessons to be learned on the ground in real operational conditions, to better refine policies, grid management, logistics, and financing models.A key step forward with this recommendation will be to recognise the top-performing cities with awards from an “EV Excellence Fund” to support further innovation. - Shifting Capital Costs to Operating Costs:

The idea is to separate the cost of ownership of expensive elements (batteries, for example) from operating the vehicle, through leasing batteries and other components, when required. - Enhancing Public Awareness & Information Systems:

Enabling EV consumer confidence could be further facilitated by using digital platforms to integrate better information systems, where real-time information regarding the availability of idle EV charging infrastructure, booking and payment, etc., would make for a simpler user experience. Improved data systems (e.g. vehicle registry, battery management system) could help enable better policymaking, compliance or enforcement and improve commercial and societal transparency.

- Transitioning from Incentives to Mandates:

-

- Financing Issues: Electric buses and trucks are 2-3 times the price of traditional internal combustion engine (ICE) vehicles, and truck and bus ownership in India is very fragmented - most owners operate five or fewer vehicles. As a result, financiers view them as riskier investments while they are costlier options to the smaller businesses.

The way forward

The strategies outlined in the NITI Aayog report provide a blueprint not just for meeting the nation's climate and energy goals, but for unlocking a $200 billion opportunity to transform the country’s transport. The recommendations are sound and if carried out as prescribed, could have a considerable impact on promoting an even stronger uptake of EVs.